Auto Appraisal Clause Cases in WA

IMPACT OF AUTO APPRAISAL CLAUSE CASES IN WASHINGTON

THE PROBLEM

Too often, insurance companies offer far less than what it would cost to repair or replace a damaged vehicle. This claims shortfall has been greatly exacerbated by the introduction of photo estimating and virtual claims processing that removes humans from interacting with the policy holder and in person vehicle inspections.

To dispute this short fall in their settlement, policy holders can demand a 3rd party appraisal called “Right to Appraisal” (not all policies have this provision). In this case, 3rd party independent appraisers each “appraise the amount of the loss”. If the appraisers can’t come to an agreement, they submit their differences to a 3rd party “umpire / mediator” to settle any differences.

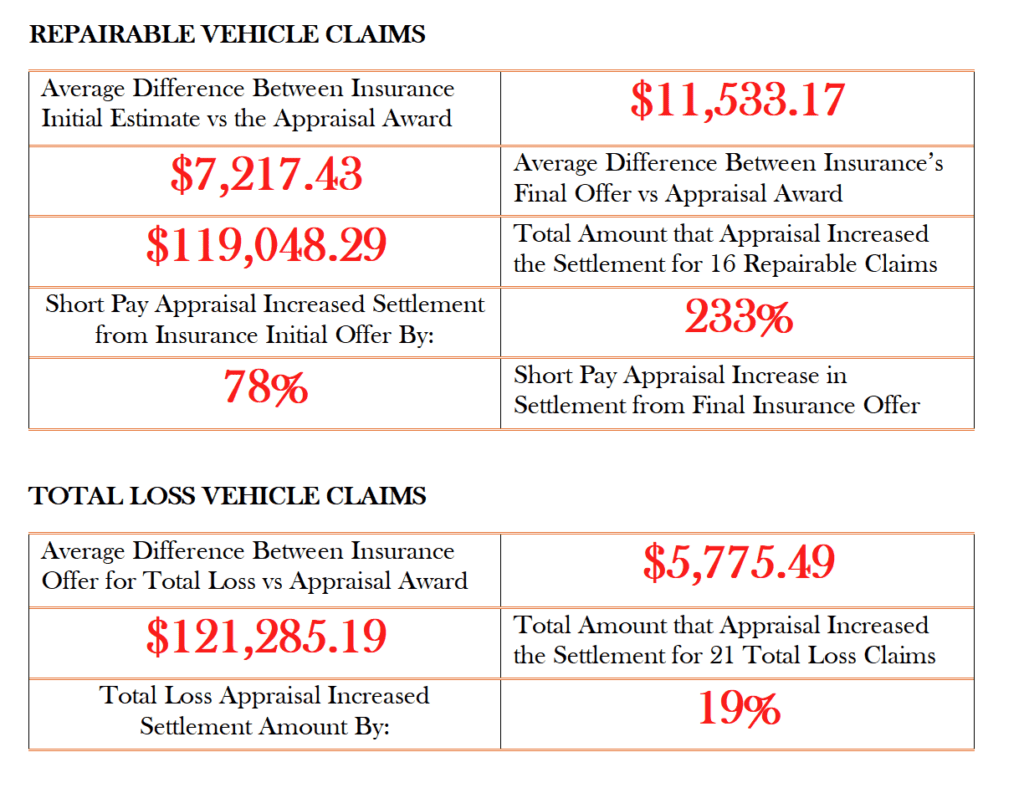

Our office analyzed 16 repair cost appraisals and 21 total loss vehicle value underpayments recently settled through the independent appraisal process and concluded the following information:

However, when the insured chooses to proceed with appraisal, they incur costs in the pursuit of reaching a fair settlement value for their total loss or short pay claim. These fees include the independent appraiser’s fees, expenses during appraisal, umpire / mediator fees and the amount of time it takes for both appraisers to negotiate and reach an agreement and select an umpire. From our own experience, we have seen cases take anywhere from one week to one year and costs ranging from $550 to $4000. These appraisal costs are effectively a second deductible the insured is required to pay to be fully indemnified (made whole).

Fair auto insurance appraisal allows consumers and insurers to determine the cost to repair vehicles and determine the value in total loss situations. Without appraisal, consumers would be forced to accept the insurer’s low offer and pay out-of-pocket expenses for any disputed amounts or taking on the costly and time-consuming burden of taking their case to court. Most lawyers will not take automobile property damage case to court on a continuance basis leaving consumers exposed to large financial risks and unreasonable amounts of time just to be made whole.

THE SOLUTION

PASS HB 2011 By Representative Strom Peterson

HB 2011 levels the playing field between the insurance adjuster and the policy holder and provides a remedy to the fees from pursuing a 3rd party appraisal. If the outcome of appraisal award is more than the insurers offer prior to appraisal being invoked, the insurance company will be responsible for the fees associated from appraisal process and the policy holder must be reimbursed for these costs.

The appraisal provision will encourage insurers to do the right thing upfront and protects consumers from out-of-pocket expenses when an insurer doesn’t do the right thing and acts in bad faith.